Private Retirement Scheme Cimb Principal

You can invest in principal prs funds through your principal distributor consultant or local bank or you can enrol online through the.

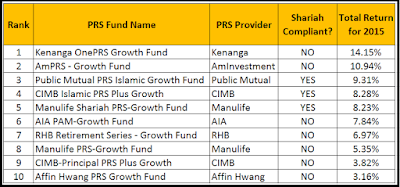

Private retirement scheme cimb principal. Private retirement scheme prs is a voluntary scheme that lets you take the lead on boosting your total retirement savings. You can obtain copies of the disclosure documents from the head office of principal asset management berhad formerly known as cimb principal asset management berhad or from any of our approved distributors. Investments in private retirement schemes prs are not obligations of deposits in guaranteed or protected by cimb bank berhad the bank and are subject to investment risks including but not limited to the possible loss of the principal amount invested. There are fees and charges involved in contributing in the private retirement scheme.

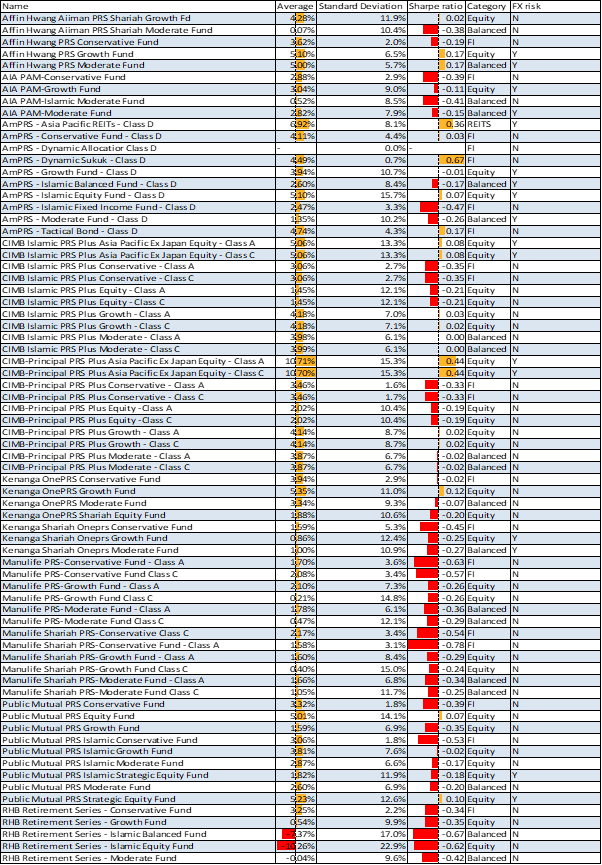

The contents in this website were prepared in good faith and the private pension administrator malaysia ppa expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. Fund offering empowering individual investors institutions and business professionals is our single purpose. Amfunds management berhad as the manager of amprs dynamic allocator the fund has terminated the trust in respect of the fund and wound up the fund on the 31 august 2019. With innovative ideas and real life solutions the company helps make financial progress towards a more secure financial future possible for clients of all income and portfolio.

Investments in private retirement schemes are not obligations of deposits in guaranteed or insured by cimb bank berhad the bank are subject to investment risks including but not limited to the possible loss of the principal amount invested. Malaysian time mondays to fridays except on selangor public holidays. Investing in the cimb principal family of private retirement schemes please call cimb principal customer care centre at 03 7718 3100 between 8 30 a m. We re finding many consumers need help with ensuring they have saved enough to have the retirement lifestyle they dreamed of and these funds are a perfect complement to your employees provident fund epf member savings.

At principal we can help you plan and build your financial well being through our experience in asset management.

.jpg)